How might we make safe deposit locker booking better, easier and more accessible

Introduction

Kotak Mahindra Bank is one of India’s leading private sector banks, renowned for its innovative financial solutions and customer-centric approach. In this case study, I’ve explained how we digitalized Physical safe deposit locker booking and how I’ve built the Locker booking system from the scratch.

Role

UX designer

Team

Me (UX designer),

Design lead

2 Product managers

Bank Agency Managers

Project tenure

3 months

Tools

Adobe XD

Adobe Illustrator

The challenge 🎯

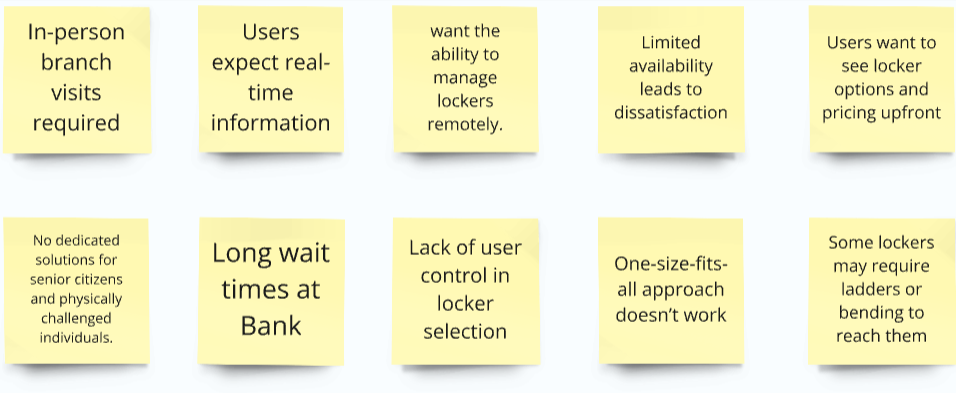

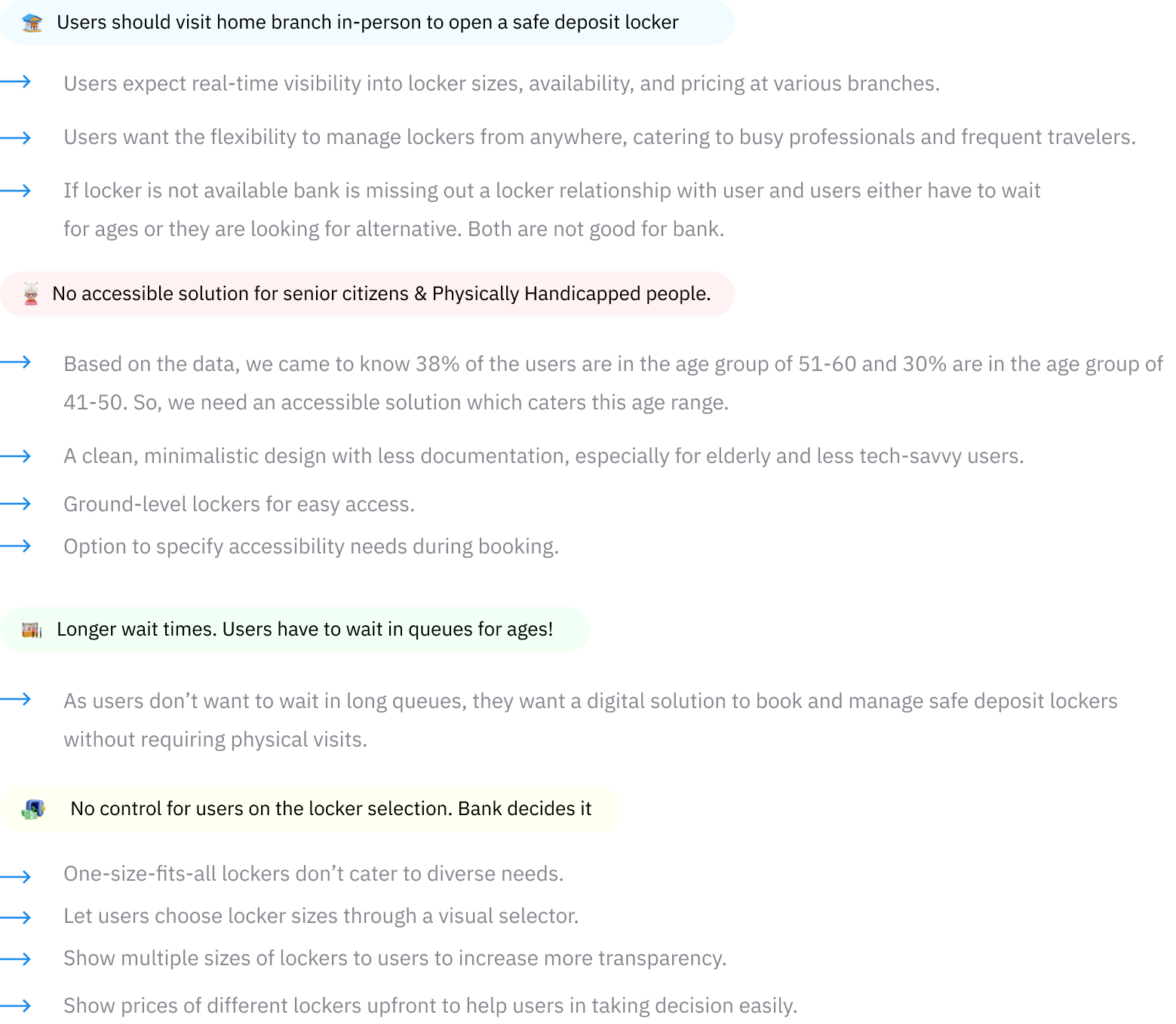

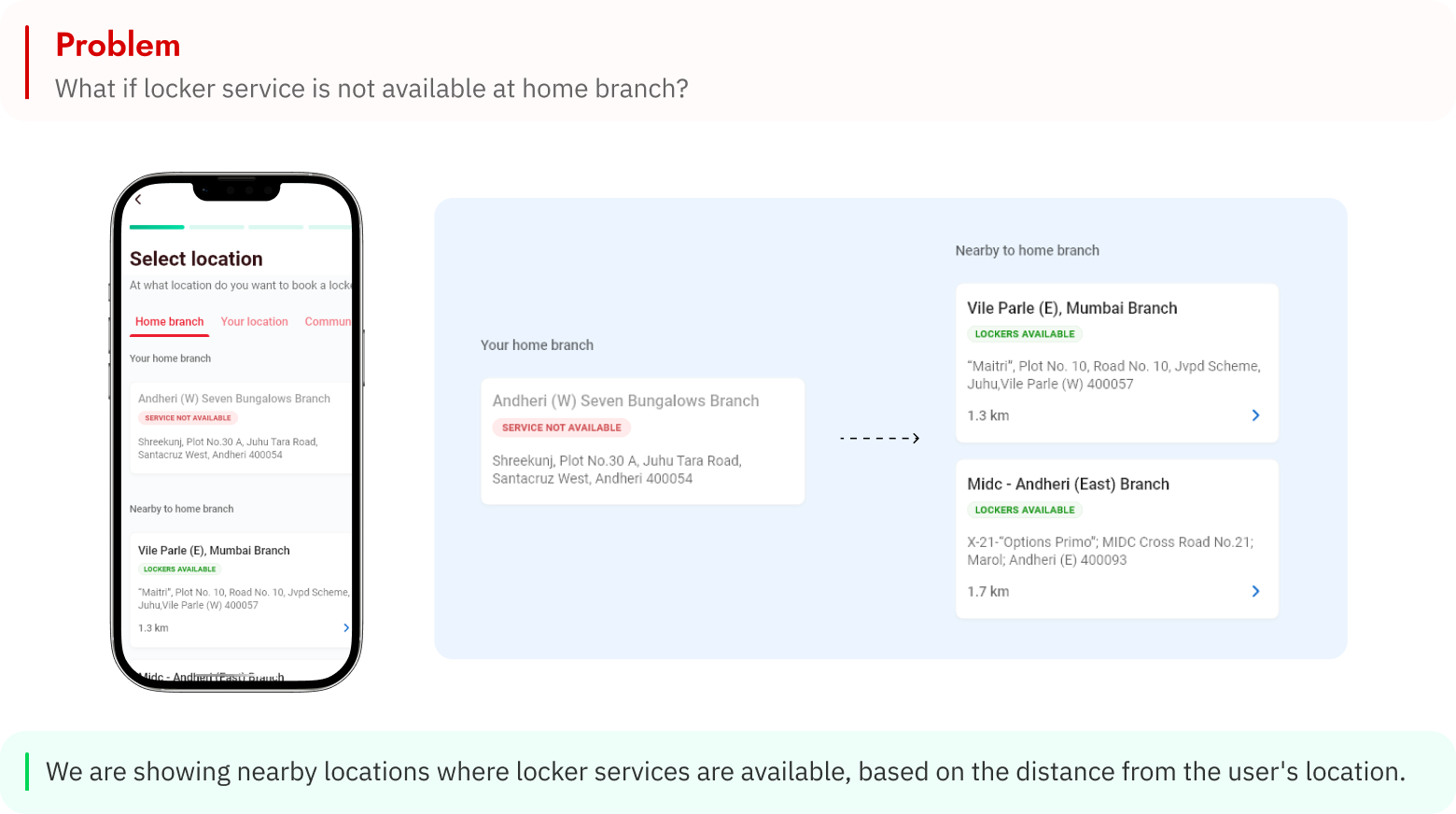

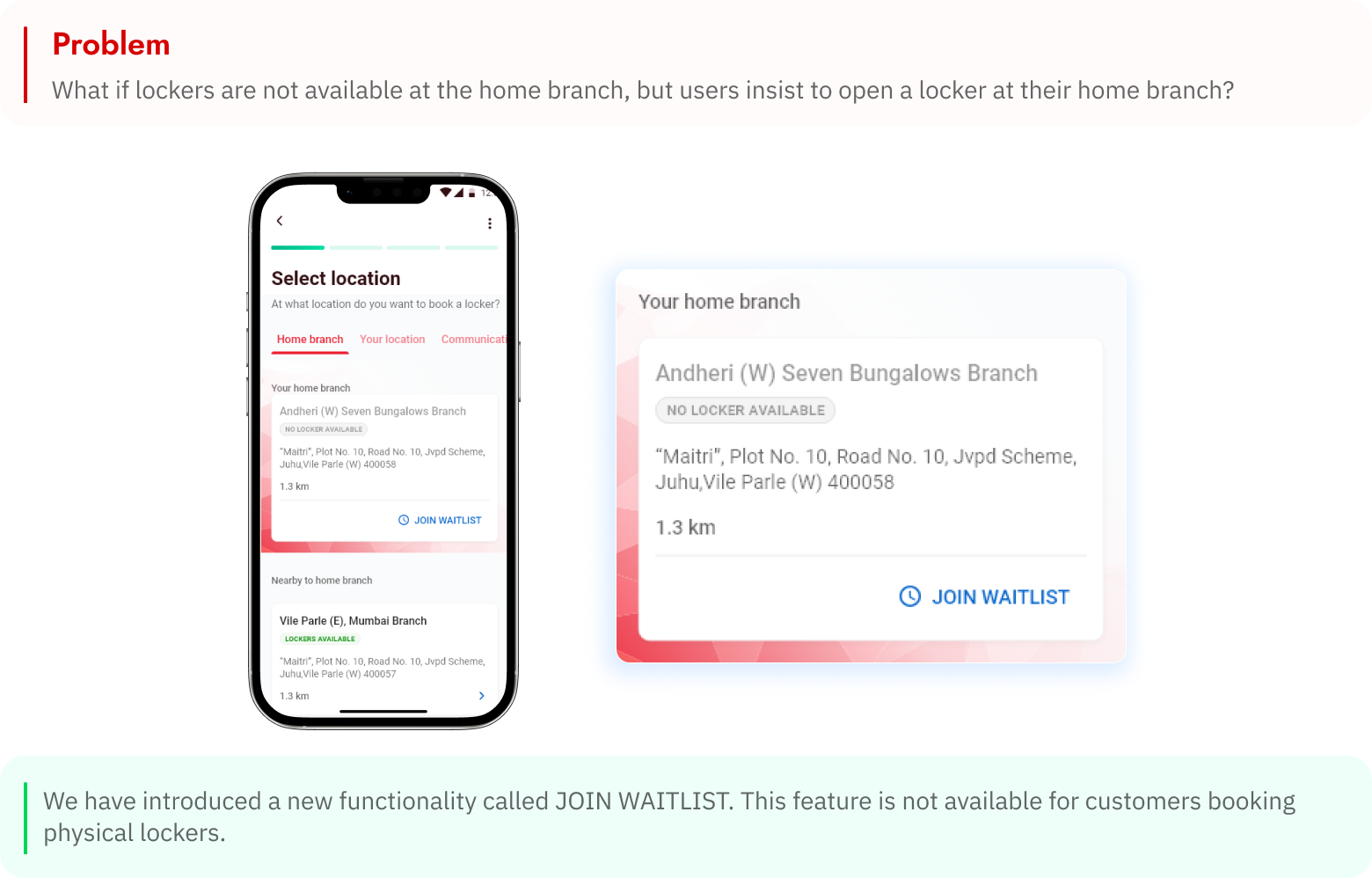

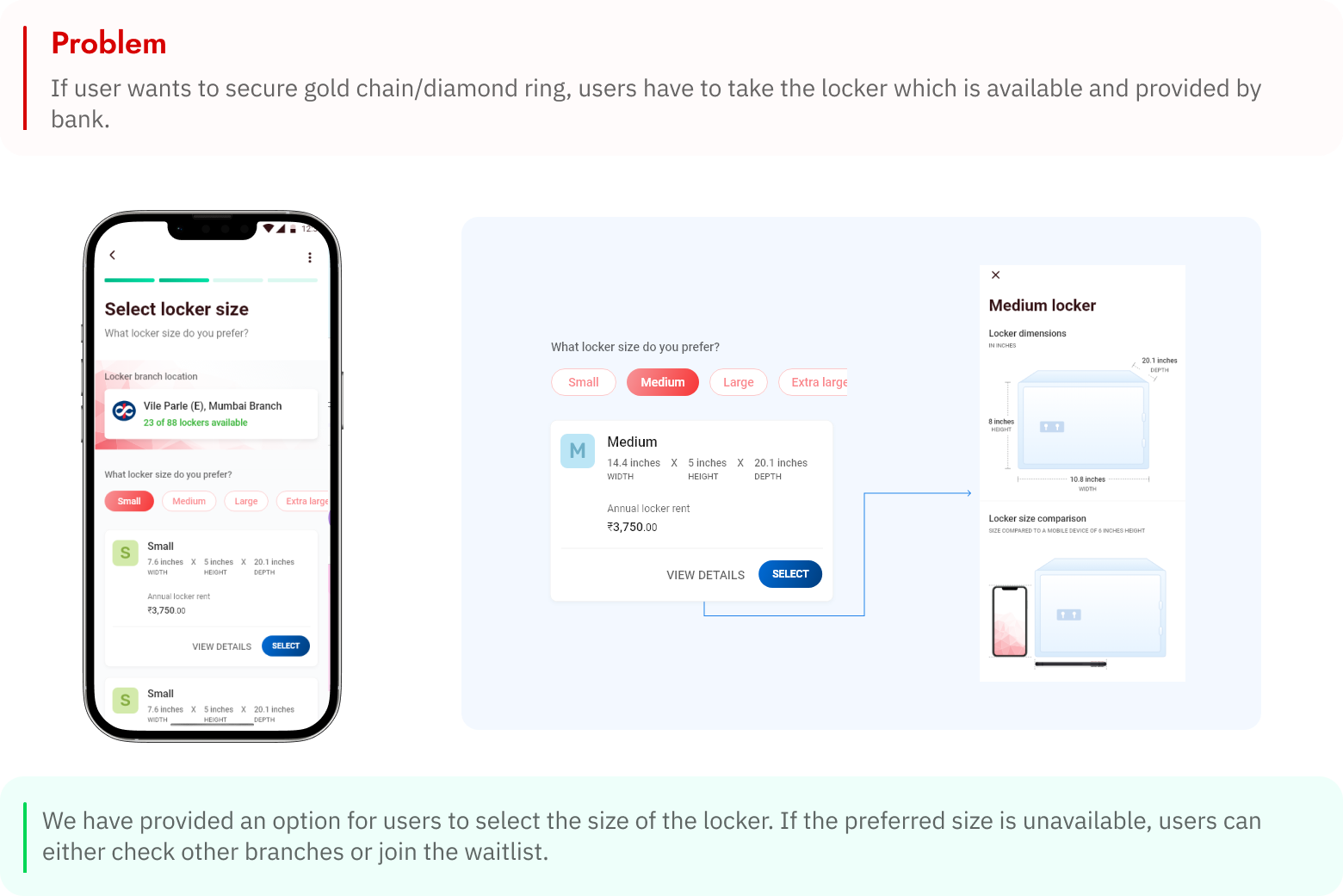

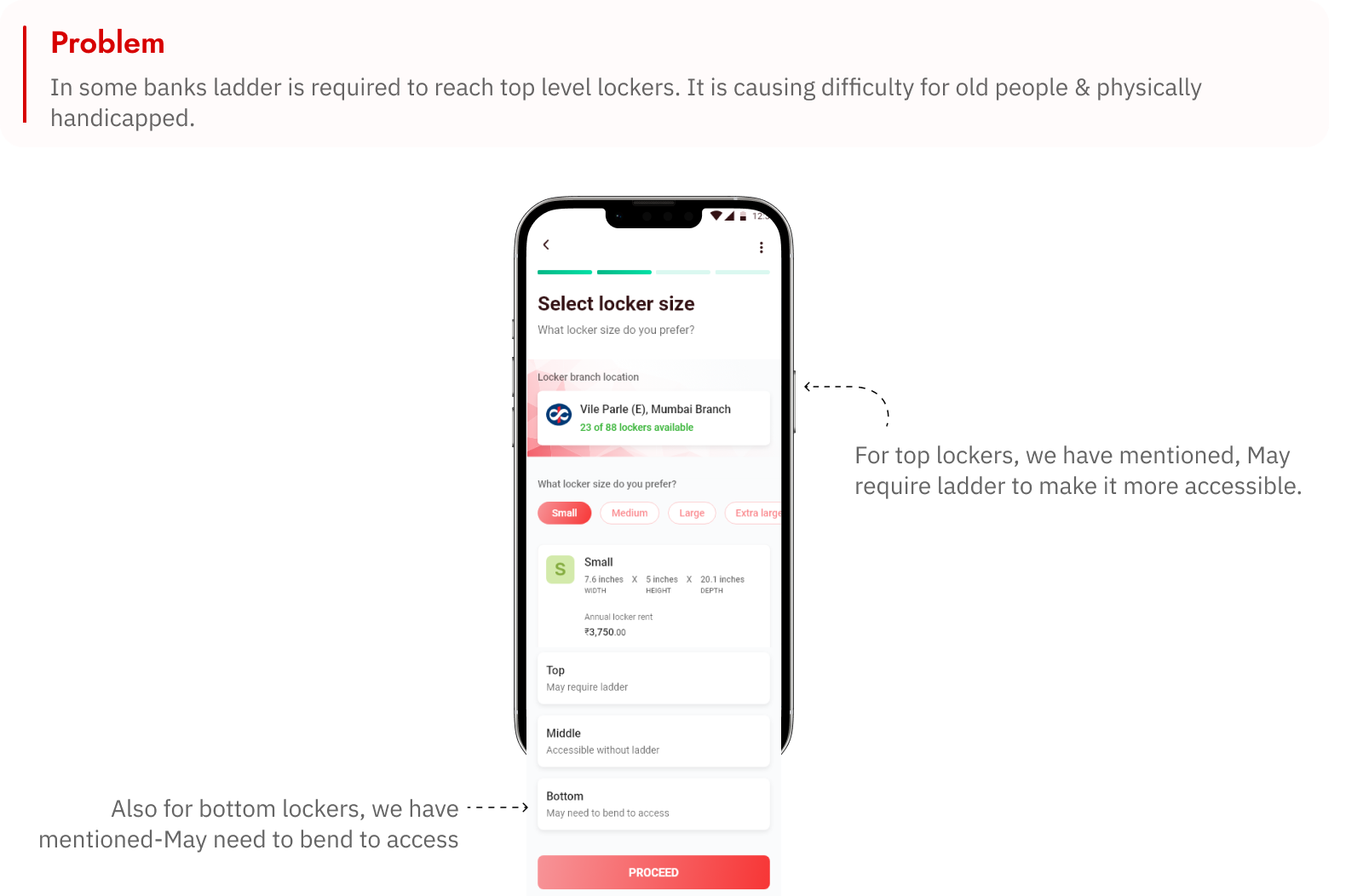

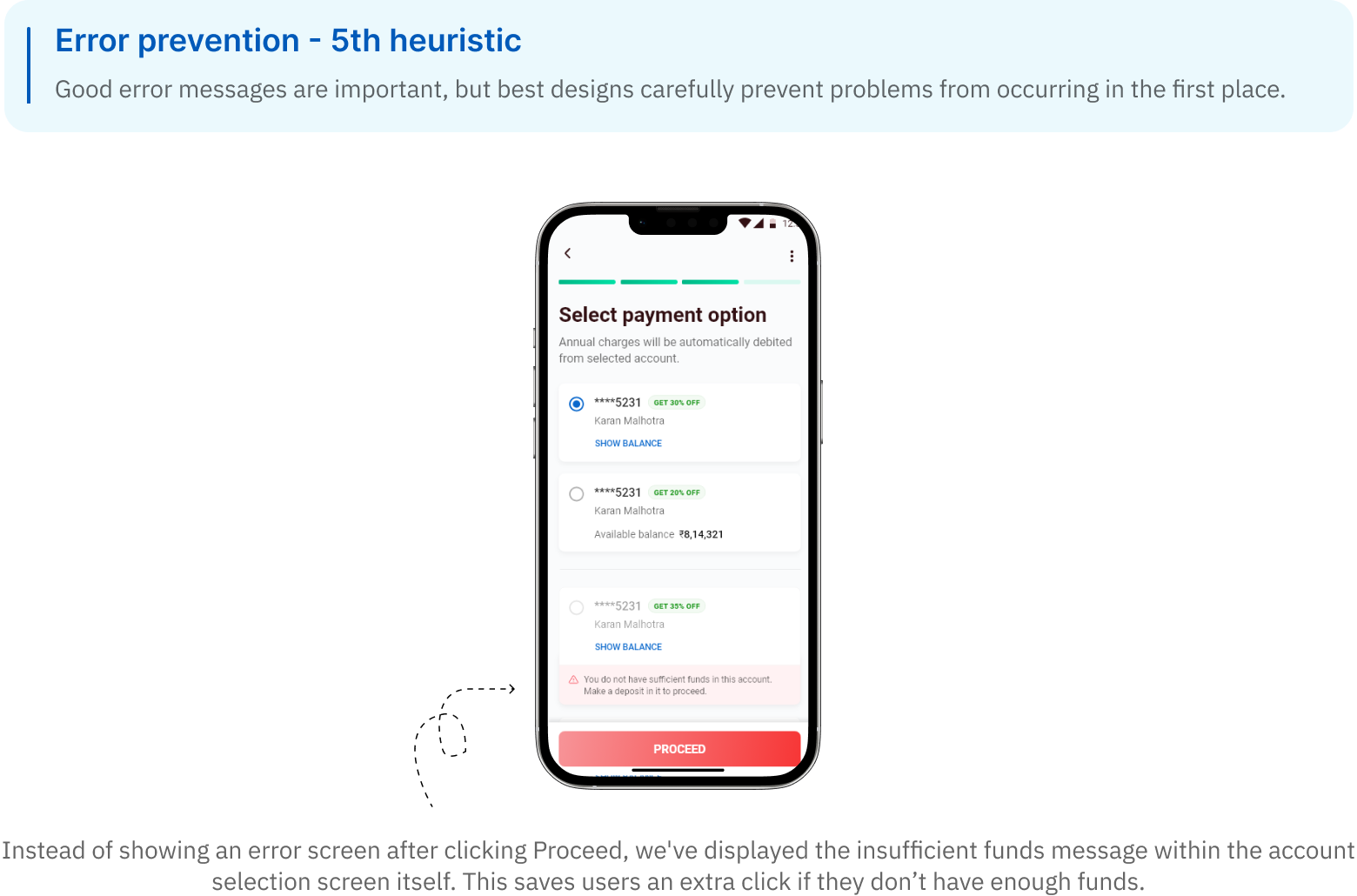

The locker booking process at Kotak Mahindra Bank is inconvenient and inefficient, requiring customers to visit a branch physically. Users seek a digital solution to book and manage lockers, avoiding long queues and physical visits. The current system is also inaccessible for senior citizens and individuals with physical disabilities, as some lockers require ladder access.

Business Statement 🏦

High-value clients, such as Privi users, face challenges when trying to book safe deposit lockers remotely. Currently, they must visit the bank in person, which is inconvenient and time-consuming. There is a need for Kotak Mahindra Bank to implement a locker booking feature within its mobile and net banking platforms to provide a seamless experience for Privi users, enabling them to secure lockers easily without the need for in-person visits.

The solution 💡

Enhancing Kotak Mahindra Bank’s digital locker booking system with a UX-driven approach and streamlined interface.

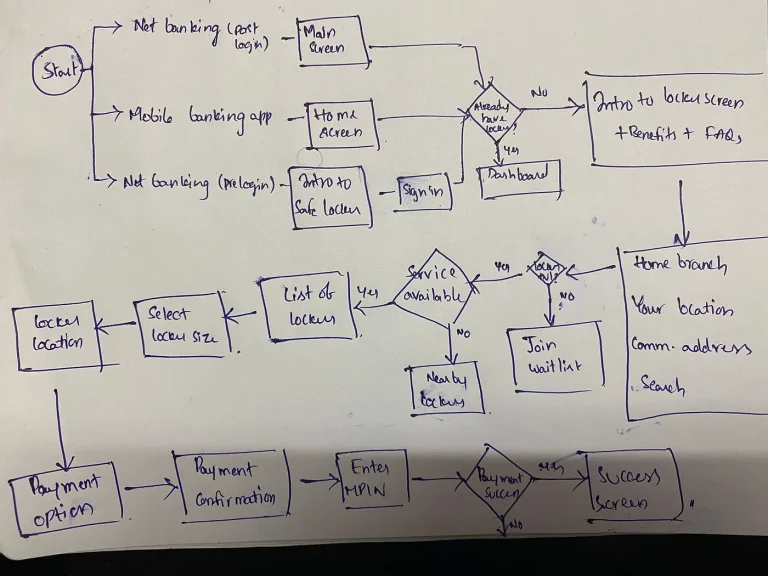

- Designed a digital app flow for for locker booking system, tailored for Privi-league users of Kotak Mahindra Bank.

- Considered Accessibility and inclusive design to make the experience better for Senior citizens and Physically challenged people.

- Integrated key components into the existing Style guide to maintain consistency and streamlined the interface for a clutter-free booking experience.

Timeline

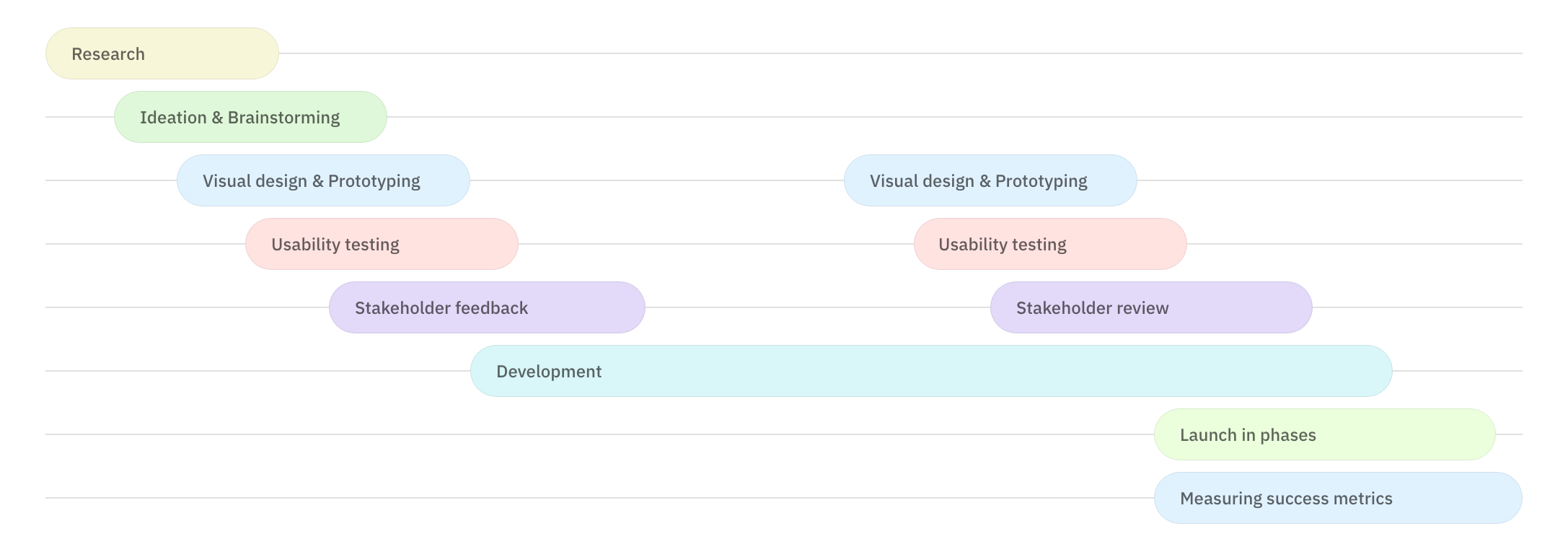

A rough visual representation of the whole process from inception till measurement

Preface

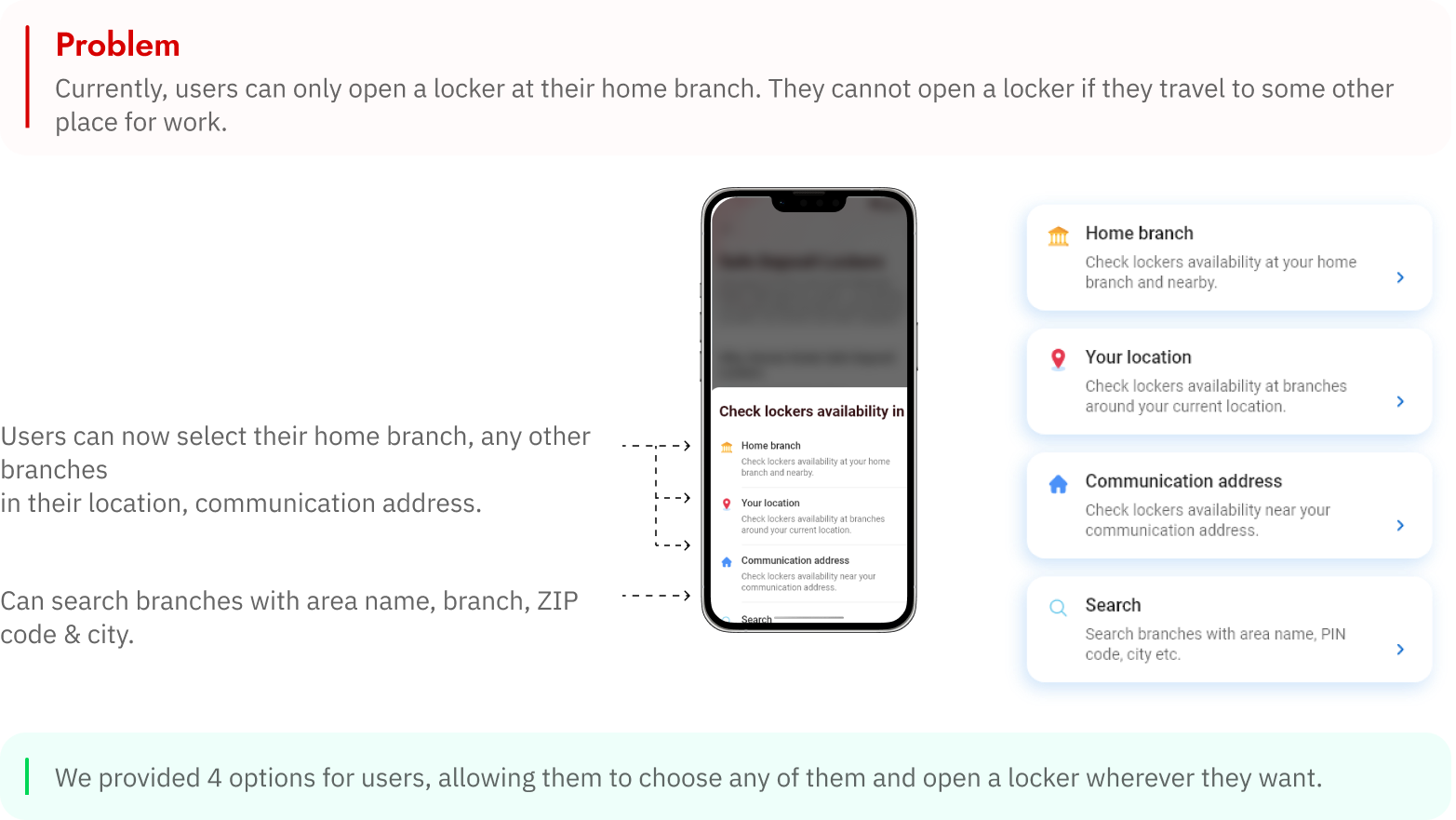

India is not for beginners. Just kidding! Banks to population ratio is is approximately 1 bank per 14,600 people. If we narrow down safe deposit lockers to population, 1 locker per 567 people. At Kotak, they provide locker facility for Privi persona, who maintain monthly bank balance of ₹15 lakh/ $18,000. So it results in long waiting times at bank and locker facility for very limited people. It’s a bit of hassle in India to book a locker, as customers have to go to the bank where they opened their bank account.

Solution

Learnings

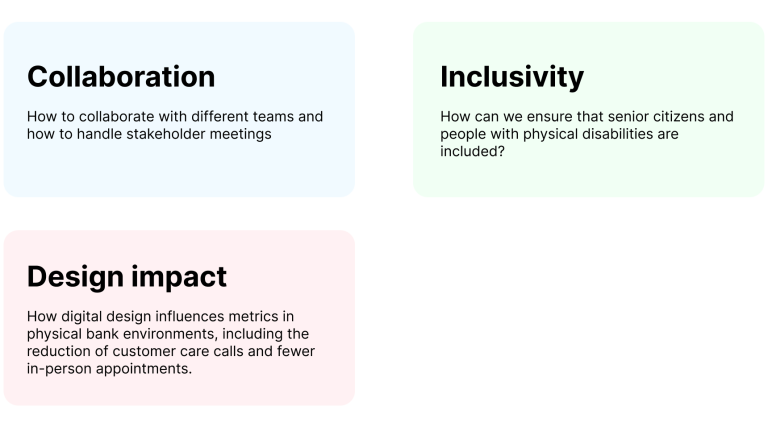

This is one of my favorite projects so far because I tackled the problem in a new way. We focused on fully educating users about this new feature. Even though it was a small project, I learned a lot from it.

Future scope

Although it saves a lot of time for both customers and bank employees, if I had more time, I would have designed the flows below. We have built the locker booking flow online, but users still have to go to the bank to collect the locker key.

- We can design a flow where users don’t have to go to bank, for identity verification

- The flow allows users to transfer items from one branch to another without going to the bank.

- Locker key will be automatically sent to home

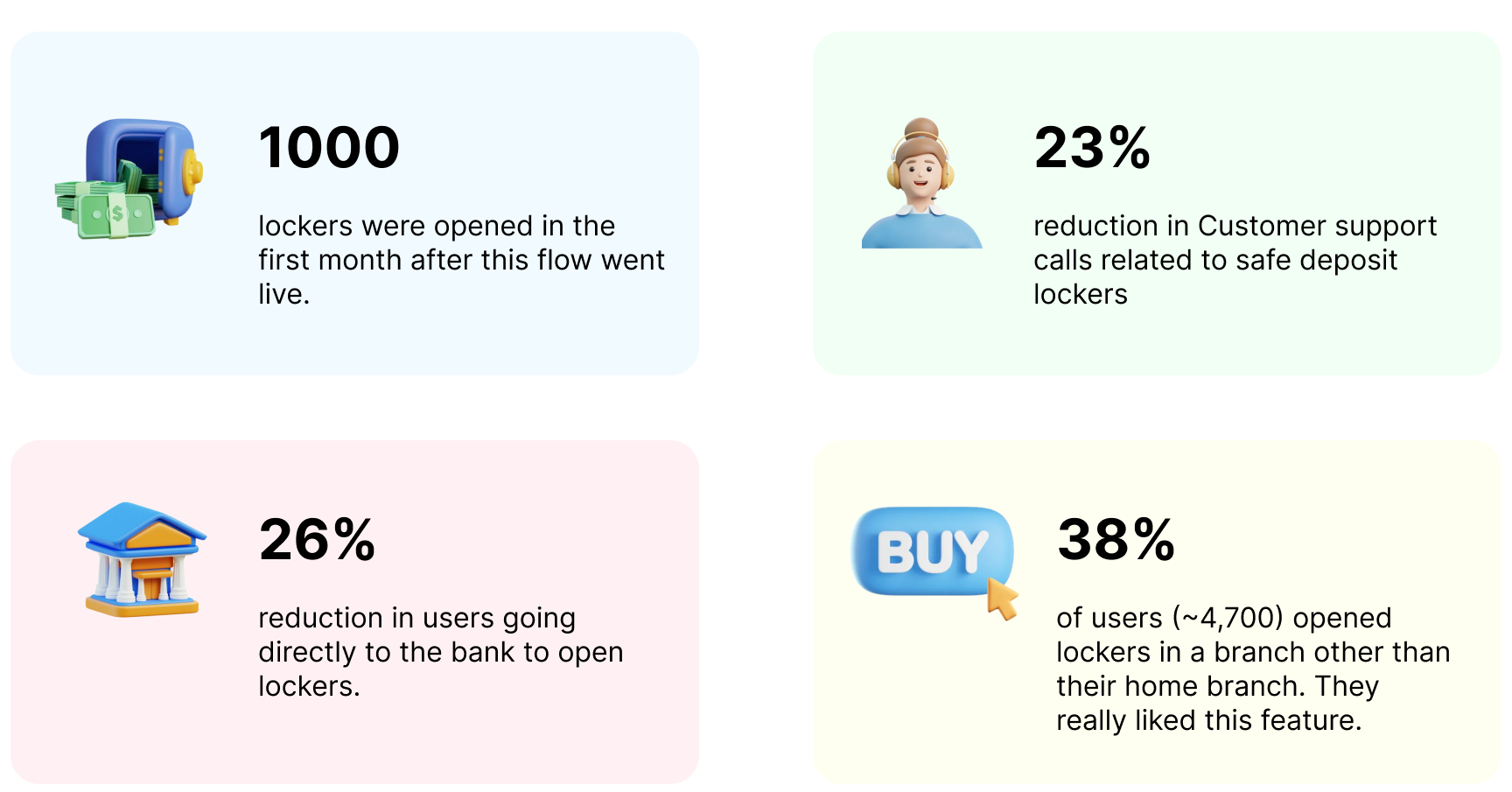

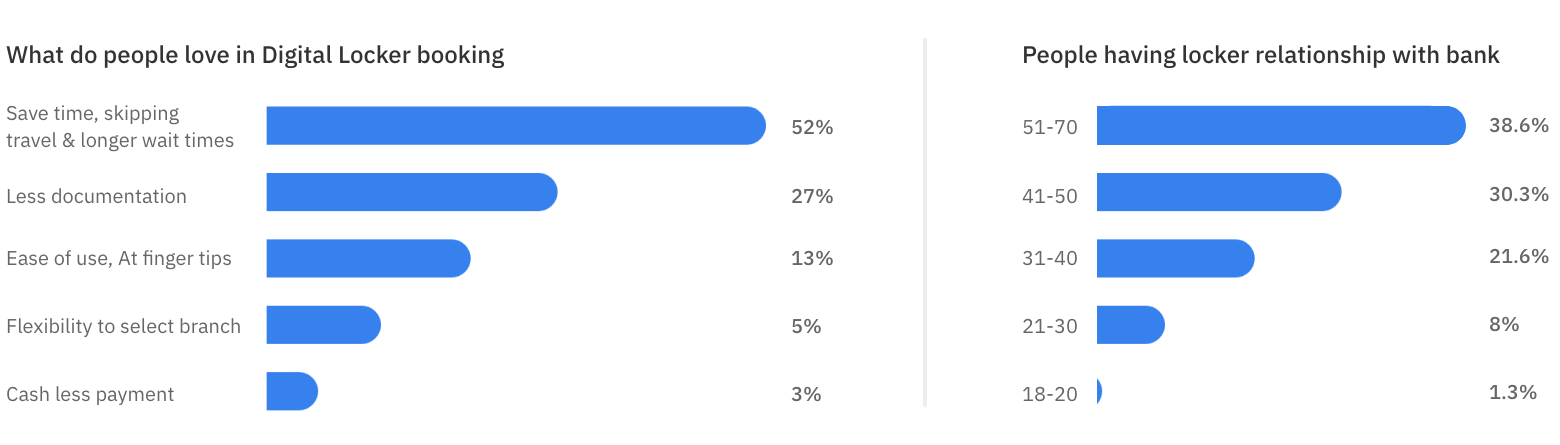

Impact